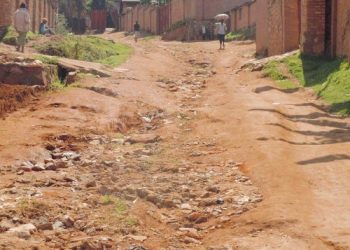

Burundi’s capital market has yet to launch legal operations, due to the lack of proper guiding regulations. This has limited investment and cash flow, leading to sluggish economic growth. Claimed Economist experts.

For Burundi, a capital market is still a novel concept, despite the concept being common in other East African Community Partner States. Nevertheless, the decree that stipulates it was promulgated on February 19th, 2019. The EAC, however, had recommended it to Burundi back in 2009.

The capital market of Burundi, especially the primary market, is still struggling to function almost four years after its promulgation due to several factors, including delayed regulatory processes and economic fluctuations.

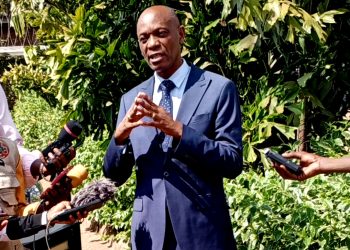

Pierre Damien Mpawenimana, head of the stock exchange unit at the Central Bank of the Republic of Burundi (BRB), mentioned it during a workshop with business journalists on June 6th, 2022. He also emphasized the importance of the capital market. In contrast, the secondary market for public loans has already begun to operate. He added.

According to Pierre Damien “The capital is a sellable product like other goods found on the market” He views a capital market as a venue for the meeting of buyers and sellers of capital. In comparison with other markets, capital markets require the services of a financial advisor.

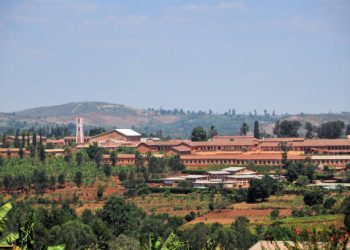

“Capital markets are financial markets that bring buyers and sellers together to trade stocks, bonds, and other financial assets. Capital markets include the stock market and the bond market. In international finance, the stock market is where shares of corporations are traded, while the bonds market is also called the debt market or credit market which is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. Capital market is an investment opportunity for participants” according to Blaise Ntahomvukiye, a Ph.D. candidate in Economics, in the major of Finance and Accounting, an entrepreneur, an author, and lecturer at Revealed Word University, Kigali Rwanda, and many other private universities in Burundi.

Steps to capital market operations.

“ I heard for the first time how the capital market operates when I was in Nairobi for Masters program, we had a course on international trade, then I found there was the capital market authority, called Nairobi Securities Exchange (NSE), I was very interested to know how it operates. I was amazed to find that Kenyans take an investment in the stock market as a must-do for any serious Kenyan who is keen on having financial freedom.

The most direct way to invest in Kenya’s publicly traded companies is to trade on the Nairobi Securities Exchange, located in the country’s capital of the same name. NSE is open Monday to Friday save for Kenyan public holidays, with working hours between 9 a.m. and 3 p.m. local time.

Transactions are carried out in Kenya shillings, therefore one must be prepared for the fluctuations that come with prevailing exchange rates. The investment strategy should be guided by how long one wants to invest in a particular stock, the risk appetite, the financial health of the company, and the individual company’s management and shareholders.

For a company to trade in the capital market, it has to be among companies that are listed in the capital market authority. For example, the Nairobi Securities Exchange operates by selling shares of about 60 listed companies categorized into 4 sectors: agricultural, commercial and services, finance and investment, industrial, and allied.

Individuals trade through brokerage firms, and even though the Nairobi Securities Exchange has enacted the Automated Trading System to enhance automated trading, individuals who want to trade in the capital market have to open an account with a broker, and their money is credited to their account three days after the sale of shares.

Buying and selling shares on the Nairobi Securities Exchanges can only be accomplished through the services of authorized stock brokers, who liaise with stock agents to help clients access the market. Once you have an account, you can trade by instructing your broker to execute the buy or sell orders.”, Blaise NTAHOMVUKIYE continues.

Investment in the capital market: Precautions

All businesspeople strive to maximize profits and wealth. Various business conditions and precautions need to be followed to achieve the above objectives. If you do not keep an eye on the capital market, your book value may decrease at any time. In order to invest in a capital market, you need to check a Company’s financial health.

According to Harvard Business School, below are 4 factors to look for.

Analyze the Balance Sheet. The balance sheet is a statement that shows a company’s financial position at a specific point in time. It provides a snapshot of its assets, liabilities, and owner’s equity.

Analyze the Income Statement: The income statement shows a company’s financial position and performance over a period by looking at revenue, expenses, and profits earned. It can be created for any period using a trial balance of transactions from any two points in time.

Analyze the Cash Flow Statement: The cash flow statement provides detailed insights into how a company used its cash during an accounting period. It shows the sources of cash flow and different areas where money was spent, categorized into operations, investing, and financing activities. Finally, it reconciles the beginning and ending cash balance over the period.

Financial Ratio Analysis: Financial ratios help you make sense of the numbers presented in financial statements, and are powerful tools for determining the overall financial health of your company. Ratios fall under a variety of categories, including profitability, liquidity, solvency, efficiency, and valuation.

Advantages and disadvantages of the capital market.

The reason the capital market exists is that investors require profits from their book values and registered companies need to raise money for their ongoing operations.

In this framework, negotiable financial securities are valued depending on supply and demand considerations. Additionally, the Burundian Stock Exchange will serve to stimulate the economy and serve as a window into the nation’s financial situation.

Other advantages include assurance of transactions and contribution to Economic Growth through investing in the most profitable investment opportunities this process of divestment and reinvestment promotes capital formation and economic growth.

The capital market also fosters a culture of corporate social responsibility investment, the possibility of profiting from price variation, liquid assets in an investment portfolio, and improved capital allocation, and encourages the practice of saving and investing. Says Pierre Damien Mpawenimana, head of the stock exchange unit at the Central Bank of the Republic of Burundi (BRB).

According to Blaise NTAHOMVUKIYE “ In the capital market, investors need to evaluate their investment styles, Some investors prefer long-term investment, as opposed to others, prefer short-term investment. Such short-term investors are traders.

They are mostly young people who prefer to make money on market swings; up and down movements of the stock market. To succeed in the stock market, you need to buy the right stocks at the right price, at the right time.

Secondly, you need emotional intelligence. Rise above your emotions” “ Some of the tips I learned when I was trading in Nairobi since 2018 are that participants should control their emotions when trading, avoid the fear of loose, avoid greediness, and don’t be overconfident.” Blaise mentioned it during the interview he gave us.

Financial information is vital in influencing the volatility of the stock market, either positively or negatively, according to Dr. Arsene Mugenzi, Head of the capital market regulatory authority body at the Central Bank of the Republic of Burundi. “Business reporters will guide or mislead the market if they are coerced by those who stand to gain significantly from an inflated capital market”. Arsene indicated.

The capital market of Burundi: challenges and solutions.

Pierre Damien Mpawenimana, Head of the stock exchange unit at the Central Bank of the Republic of Burundi (BRB), acknowledges that the cash flow movement has been restricted and maintains that only the regulatory process hinders the lawful operations of the Burundi capital market.

An entrepreneur, economist, and University lecturer, Blaise Ntahomvukiye says that a lot needs to be considered when participating in the capital market, “The capital market stock prices are determined by several factors including company performance, corporate operations, any good news, and a company’s general financial outlook.

There are two ways you can make money with the capital market. The first is capital gain, where shares are sold for higher prices than they were purchased. The other is dividend gains, where the company shares profits by distributing dividends to its shareholders.” Blaise added.

The Central Bank of the Republic of Burundi’s capital market regulatory authority body still has a chance to make the implementation successful, nevertheless.

On recall, the New York Stock Exchange remains the largest stock exchange in the world. By metonymy, it is often called Wall Street. In 2007, it was one of the few major equity markets not to be entirely electronic and to keep quotations by outcry. It was founded on 8 March 1817.

The capital markets in the East African Community (EAC) followed and dated back to the 1950s with the establishment of the Nairobi Securities Exchange (NSE) in 1954 in the then East African British Protectorate. The NSE was the stock exchange for the entire East African British Protectorate with listed companies from present-day Uganda, Kenya, and Tanzania.

By Avit Ndayiziga.